The universe of Alternative Investments is exploding, with projected growth of almost 60% from 2018 to 2023 to over $14 trillion in assets under management1. Alternative Investments are increasingly regarded as essential for a diversified approach to portfolio construction for investors fearing a recession, rising inflation, a volatile stock market or simply to enhance yield in a low interest rate environment. As wealth advisors increase their use of alternatives, they should pay very close attention to how fund sponsors and product providers use the catch-all label “alternative investments” — it is widely misused and misunderstood by many.

“True” Alternative Investments share several characteristics. First, they are mostly unregistered vehicles, investing in or themselves classified as exempt securities with fewer restrictions imposed by securities regulators. Second, they are designed to be uncorrelated to most traditional investments such as equities and bonds. Third, they may use significant amounts of leverage by purchasing securities on margin or by going short to express their investment strategy. Fourth, liquidity terms are designed to match the duration of investments made, meaning that the advisor should be aware that many true alternative investment strategies are longer-term portfolio opportunities and are best considered illiquid.

One way alternative investment strategies have broadened their acceptance is through the growth of so-called “Liquid Alternatives,” or “Liquid Alts.” These should be thought of as a subset of the alternative investment universe and are often a poor substitute for true Alternative Investments. Liquid Alts are often public, registered structures and usually come in the form of 40 Act Funds like daily open-end funds mutual funds and ETFs, Interval Funds, Business Development Corporations (BDCs) and listed closed end funds.

The fact remains that even though Liquid Alts were considered initially to be Alternatives Investments what ETFs are to mutual funds, their usefulness as a diversifier and/or alpha generator is, at best, lacking, perhaps explaining why their growth has been disappointing. There are several key structural issues that highlight why Liquid Alts should not be considered true Alternative Investments.

STRATEGIES: Advisors should generally use Alternative Investments to maximize diversification, reduce portfolio risk and produce excess returns uncorrelated to the traditional markets. True Alternative Investments offer a much broader range of strategies than are available in the Liquid Alts market. For example, private equity or equity ownership not listed on a public exchange can take the form of venture capital (funding typically directed at startups or early-stage ventures), growth capital (funding for mature companies to build out new product lines or restructure) and buyouts (funding used to purchase another company or one of its divisions). Another recently popular area has been in private debt, or a loan from a private debt fund often at attractive yields. Some or all alternative investment sub-strategies are not readily available in a registered format as Liquid Alts.

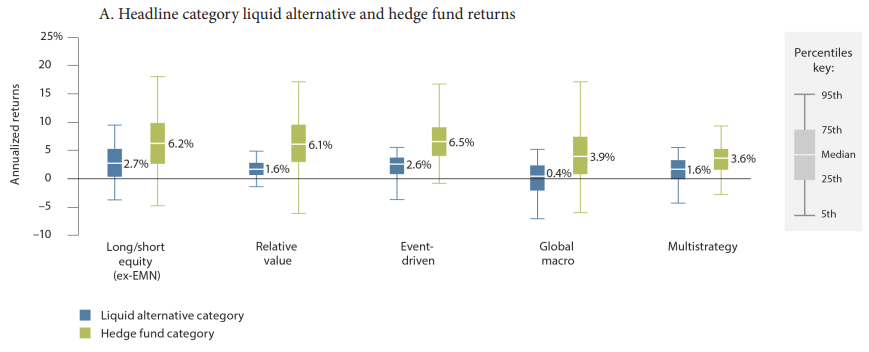

PERFORMANCE: There is a vast divergence between the investment performance of Liquid Alts and True Alternative Investments. Looking at just hedge funds vs the universe of liquid alt hedge funds across July 2003-June 2018 period data2 (graphic below), the annualized median hedge fund strategy outperformed hedge fund liquid alts from 450 bps for relative value managers to a low of 200 bps for multi-strategy managers. This is a meaningful differential.

Moreover, registered PE fund of funds, for example, often invest in existing private equity funds or into co-investments alongside underlying funds. As a result, these PE liquid alts tend to reduce outperformance by an average of 240 bps per year3. Again, this is significant.

FEES: Another factor to consider is the role of fees. In the case of private equity registered vs unregistered vehicles, the former, in fund of fund PE format, are often forced to be more active in portfolio construction, demanding investors fully fund their investment upfront for their Accredited Investor base, even though not all capital will be invested until underlying funds call the capital for investments. This implies higher operating expenses, and a generally higher cash drag on returns.

LIQUIDITY: While Liquid Alts can often be portrayed as being more liquid and easier to access, that is not always true, and this perceived liquidity comes at a hefty price. Typically, Liquid Alt structures need to carry much higher cash balances to fund potential liquidity from redemptions — this can often be as high as 15-18%. This significantly limits the amount of capital being put to work in the underlying target strategy, thus limiting the return potential of the fund.

True Alternative Investments are often critiqued for their opacity and lack of access. While historically accurate, recent technological and structural breakthroughs now offer forward thinking advisors and fiduciaries a way to gain broad access to objectively sourced true Alternative Investment strategies with simplified/digital paperwork, access to manager & fund due diligence and full fee transparency, without having to sacrifice portfolio diversification and less than optimal risk-based returns per alternative strategy.

About Proteus:

Proteus is an alternative investment platform solution for high-end wealth advisors. Along with its research partner, Callan Associates, the Proteus Platform provides sophisticated access to objectively-sourced institutional-quality investment opportunities, including private funds, alternative investment model portfolios and sub-asset class pools which invest across the alternative investment strategy spectrum. Wealth advisors and their Accredited Investor and Qualified Purchaser clients use the platform to research alternative investment managers and investments, review due diligence materials and construct custom portfolios all on one platform, thereby eliminating significant hurdles and inefficiencies that have plagued alternative investors for decades. Proteus’ fully integrated platform is an end-to-end enterprise solution which also provides sophisticated portfolio construction tools, integrated & compliant portfolio accounting and consolidated K-1 processing. To learn more about Proteus, visit: http://www.proteuscapital.us/.

Sources

- Press release 10.3.2018, Preqin

- The Wrapper Matters: Comparing Liquid Alternatives and Hedge Funds, Tidemore & Berkowitz, 1Q2020

- Private Equity Outperformance Remains Elusive for Individuals, K. McGuire, Aditum Alternatives, 07.28.2021